|

Return to: Undergraduate Education

Students at USC benefit from federal, state and university need-based financial aid programs administered by the Financial Aid Office and from scholarships administered by the Office of Admission and various academic departments. USC also offers an interest-free monthly payment plan, a tuition pre-payment plan, and participates in long-term student and parent educational loan programs.

Although international students are not eligible for need-based financial aid, they may be eligible for scholarships offered by their schools or departments. International students should contact their departments directly for information about existing opportunities. International students may also be eligible for private educational loans.

The Financial Aid Office may change these policies at any time to ensure continued compliance with changes in federal and state regulations governing student financial aid. As a result, students must refer to the current catalogue regulations. Unlike degree requirements, changes in regulations, policies and procedures are immediate and supersede those in any prior catalogue.

Application Procedures and Eligibility Requirements for Financial Aid

Detailed information, application procedures and deadlines for financial aid are available online at financialaid.usc.edu. To be eligible for federal, state and university need-based financial aid programs, students must be U.S. citizens, permanent residents or other eligible non-citizens; have a valid Social Security number; meet Selective Service registration requirements; have a high school diploma, GED or equivalent; meet Satisfactory Academic Progress (SAP) requirements; and meet all other eligibility requirements. Students must also complete all application requirements by the relevant deadline(s). For most federal and state awards, a minimum of half-time enrollment is required. Full-time enrollment is required for most university awards. Enrollment status will be calculated based only on those courses that are required for, or that can be applied as an eligible elective credit toward, a student’s degree or certificate program. Students awarded a California Dream Grant are considered for limited university financial aid.

Scholarships

Scholarships awarded on the basis of academic achievement, leadership, service and talent are available through the Office of Admission, most academic departments at USC, alumni groups, and outside agencies and foundations. Some of these awards require a separate application. In some cases, financial need is also considered. For more information, visit usc.edu/scholarships and usc.scholarshipuniverse.com.

Grants

The Financial Aid Office awards need-based University Grants to eligible students with demonstrated need who meet all financial aid application deadlines.

Federal Pell Grants and Federal Supplemental Educational Opportunity Grants (FSEOG) are available for students with exceptional financial need. The SEOG is awarded only to eligible students who meet all application deadlines.

Cal Grants A and B are administered by the California Student Aid Commission. All undergraduate aid applicants who are residents of California are required to apply. Cal Grant A provides funds for partial tuition and fees. Cal Grant B recipients receive a subsistence award the first year and receive a subsistence award and tuition award in subsequent years.

Federal Work-Study

The Federal Work-Study program enables eligible students to earn funds through employment either on campus or with an approved off-campus employer. Only students who meet all application deadlines and federal eligibility requirements are considered for this program.

Federal Student and Parent Loans

Direct Subsidized and Unsubsidized Loans are also available to eligible students. Repayment begins six months after the borrower graduates, withdraws or ceases to be enrolled at least half time.*

Direct Parent PLUS Loans are available to parents of dependent** undergraduate students who meet the credit criteria established by the U.S. Department of Education. Payments may be deferred while the student is enrolled at least half time.*

*Enrollment status will be calculated based only on those courses that are required for, or that can be applied as an eligible elective credit toward, a student’s degree or certificate program.

**Undergraduate students considered dependent for the purpose of receiving federal financial aid

Private Financing Programs

Private financing programs are available to help students and parents meet the costs of education by providing long-term financing options. Students should exhaust all federal Title IV assistance available, including Federal Pell Grants, the Direct Loan and the Direct Parent PLUS Loan, before considering a private student loan program. The repayment terms of federal programs may be more favorable than the terms of private loan programs. Unlike private loan programs, federal student loans are required by law to provide a range of flexible repayment options, including but not limited to, income-based repayment and income-contingent repayment plans, and loan forgiveness benefits. Direct Loans are available to students regardless of income.

For more information about student loan programs, visit financialaid.usc.edu/loans.

Financial Aid for Double Majors or Dual Degrees

Federal and state regulations governing the Federal Pell Grant, Federal SEOG Grants and the Cal Grant limit these awards to students who have not yet earned a baccalaureate or professional degree. Similarly, the university limits awards of the university need-based grant and Federal Work-Study to students who have not yet earned their first bachelor’s degree.

Students who are planning to double major or pursue a dual degree should carefully plan their academic course work with their academic adviser to ensure that they remain eligible for federal, state and university financial aid. The best approach is to make sure you complete the requirements for both degrees or majors simultaneously in the same semester. Once the requirements for one major/degree have been satisfied, a student will only be eligible for limited financial aid (Federal Work-Study and Direct Loans) as a second bachelor’s student.

Financial Aid for a Second Bachelor’s Degree

Students who are pursuing their second bachelor’s degree are eligible for a limited number of financial aid programs, specifically Direct Loans. Parents of dependent* students may also borrow Direct Parent PLUS Loans.

*Undergraduate students considered dependent for the purpose of receiving federal financial aid

Financial Aid for Enrollment in a Progressive Degree Program

The Financial Aid Office determines aid eligibility based on a student’s class level. For information on how specific types of aid may be affected by class level, refer to financialaid.usc.edu/general/special-programs/progressive-degrees.html.

Class Level Determination for Progressive Degree Programs

While classified as an undergraduate, a Progressive Degree student’s enrollment status and financial aid eligibility are determined by undergraduate standards.

While classified as a graduate, a Progressive Degree student’s enrollment status and financial aid eligibility are determined by graduate standards.

A progressive degree student transitions from undergraduate to graduate class level as soon as any one of the following conditions is met:

- the bachelor degree is conferred; or

- the student is awarded a graduate research or teaching assistantship as contracted through the academic department and the Graduate School; or

- the student earns a total of 144 units.

Bachelor Degree Conferred

The Office of Academic Records and Registrar determines when a student has completed their bachelor degree and manages the process of posting degrees to a student’s record. Students wishing to change the degree date from that indicated on their STARS Report should request an updated degree term at the Registrar One Stop Center, John Hubbard Hall (JHH 114) or onestop@usc.edu. Students may also update their expected graduation date at my.usc.edu.

Graduate Research/Teaching Assistantship

Research and teaching assistantships are awards contracted through the student’s academic department and the Graduate School and are exclusively available to graduate students. A progressive degree student who is awarded a research or teaching assistantship will be reclassified as graduate student beginning the semester the student first receives the award.

The 144-Unit Limit

Assuming one of the other two conditions have not already been met, a progressive degree student is classified as an undergraduate up to and including the semester the student earns a total of 144 units.

All units earned at USC, from both undergraduate- and graduate-level course work, will be counted toward the 144-unit limit. Any and all units earned during summer semesters will be counted, as well as units earned during semesters that were not funded with financial aid.

All transfer units, including units accepted from Advanced Placement and International Baccalaureate exams, will also be counted toward the 144-unit limit. Requirements that were met by transfer courses cannot be substituted by subsequently taken USC courses, and USC will not delete or discount accepted transfer course work from the transcript.

Transfer course work determined not to be applicable toward subject-specific requirements, e.g., General Education and major requirements, nor applicable as “free” electives toward the bachelor degree program’s minimum unit requirement, may increase the unit limit above the standard 144. This determination is based on the student’s major(s) at the time of admission to the progressive degree program. Any subsequent change of major or addition of a major may change how transfer units are applied toward subject-specific requirements and free electives, and the unit limit may increase or decrease accordingly. However, the applicability of transfer units is determined from objective transcript data and is therefore not open to appeal.

Class level is determined dynamically based on currently available data in the student transcript. Any changes, updates or corrections to a student’s transcript that alter the total number of units earned will affect progress toward the unit limit and class level transition.

Financial Aid for Limited Status Enrollment

Students not admitted to a degree-seeking program who enroll as limited-status students are not eligible for most types of federal, state or university financial aid. Students who have completed their degree or certificate programs, but continue to enroll, will be considered limited-status students and are thereby ineligible for financial aid.

Financial Aid Consortium Agreements

Students admitted to a degree-seeking program at USC who enroll in course work at another eligible “host” institution, where the course work has been pre-approved as transferable for credit toward their USC degree, may have those courses considered in USC’s determination of their eligibility for limited federal financial aid. The student’s total USC and/or non-USC enrollment must be at least half-time (the equivalent of at least 6 USC units per semester) and a Financial Aid Consortium Agreement must be completed prior to the semester or semesters the student enrolls at the host institution. Financial Aid Consortium Agreements are contingent upon the host school agreeing to participate.

Financial Aid Consortium Agreements are not available for students participating in the Postbaccalaureate Premedical Program. For more information, visit financialaid.usc.edu/general/special-programs/consortium-agreements.html.

Financial Aid for Students Enrolled in Undergraduate Course Work for Admission to Graduate Degree

Students enrolled at least half-time in undergraduate courses required for admission to a graduate degree program may be eligible for limited Direct Loan program funds. At this time, the only such program that USC offers is the Postbaccalaureate Premedical Program. For more information, visit financialaid.usc.edu/general/special-programs/postbaccalaureate-premedical-program.

Satisfactory Academic Progress (SAP) Policy

Purpose

To be eligible for federal, state and university aid, students are required by the U.S. Department of Education (34 CFR 668.34) to maintain Satisfactory Academic Progress toward their degree objectives. USC has established this SAP policy to ensure student success and accountability and to promote timely advancement toward degree objectives.

The following guidelines provide academic progress criteria for all undergraduate students receiving financial aid at USC. The guidelines are based on reasonable expectations of academic progress toward a degree and should not be a hindrance to any student in good academic standing.

Table 1

Programs Subject to Financial Aid SAP Policy

| Federal and State Programs |

USC Programs |

| Federal Pell Grant |

University Grant |

| Federal Work-Study |

|

| Iraq and Afghanistan Service Grants |

|

| Direct Subsidized Loan |

|

| Direct Unsubsidized Loan |

|

| Direct Parent PLUS Loan |

|

| California State Cal Grant |

|

Table 2

Programs Not Subject to Financial Aid SAP Policy

| USC and Outside Programs+ |

| USC Merit Scholarships |

USC Alumni Scholarships |

| USC Topping Scholarships |

USC Departmental Awards |

| USC Assistantships |

USC Employee Tuition Assistance Benefits |

| Sponsored Agency Awards (Including Department of Defense and Veterans Awards) |

Outside Agency Scholarships |

+Recipients of these awards should contact the awarding agencies/departments for rules regarding award retention.

Definition of Undergraduate SAP

To be eligible for financial aid identified in Table 1, undergraduates must maintain SAP as defined by the following three criteria:

- Grade Point Average (GPA): You must meet a minimum cumulative GPA of 2.0 each enrolled semester.

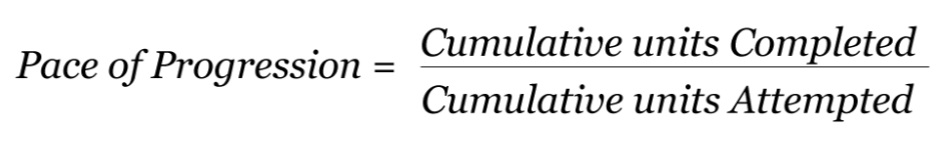

- Pace of Progression: You must successfully complete a minimum of 67 percent of all cumulative attempted* units each enrolled semester. This Pace of Progression ensures completion of the degree within the Maximum Time-Frame.

- Maximum Time-Frame: You must complete your degree within a specified amount of time. The Maximum Time-Frame is based on the published length and unit requirements for your degree program(s). You will be eligible for the maximum attempted units or the maximum SAP semesters, whichever comes first.

If you do not meet the Pace of Progression or GPA requirements, you will be placed on a one-time, one-semester financial aid SAP Warning Period. If the minimum requirements are not met by the end of the Warning Period, you will no longer be considered to be making SAP and will become ineligible for financial aid without an approved, written SAP Appeal.

If you have reached the Maximum Time-Frame, you will be ineligible for further financial aid without an approved, written SAP Appeal. The Financial Aid Office will never increase the Maximum Time-Frame past 150 percent of the published degree requirements. As soon as a student is mathematically incapable of completing a degree program within 150 percent of the published requirements, the student will be ineligible for financial aid from that point forward.

Grade Point Average (GPA) Requirement

Undergraduate students must meet a minimum cumulative GPA of 2.0. Refer to Tables 3 and 4 below to understand how specific grades and course types affect students’ cumulative grade point averages.

Table 3

Impact of Grades on Cumulative GPA Calculation

| Grade Earned |

Counted in Grade Point Average |

| A, B, C, D, F (+/-) |

Yes |

| CR — Credit, P — Pass, IP — In Progress |

No |

| NC — No Credit, NP — No Pass |

No |

| IN — Incomplete |

No |

| IX — Expired Incomplete |

Yes |

| W — Withdrawal |

No |

| UW — Unofficial Withdrawal |

Yes |

| V — Audit |

No |

| NS — Not Submitted |

No |

| MG — Missing Grade |

No |

Table 4

Impact of Course Type on Cumulative GPA Calculation

| Course Type |

Counted in Grade Point Average |

| Preparatory course work (course numbers below 100) |

No |

| Repeated course work (previous passing grade) |

No |

| Repeated course work (previous failing grade) |

Yes (both grades counted) |

| Transfer course work (pre- and post-matriculation) |

No |

Students enrolled in progressive degree programs who are currently classified as undergraduate students (see the Financial Aid for Enrollment in a Progressive Degree Program section above) must also maintain a minimum cumulative undergraduate GPA of 2.0.

For more information about grading policy, please visit the USC Department of Grades on the Registrar’s website at usc.edu/grades.

Pace of Progression Requirement

Undergraduate students must successfully complete a minimum of 67 percent of all cumulative attempted units each enrolled semester. This Pace of Progression ensures completion of the degree within the Maximum Time-Frame.

Full-time undergraduate students are encouraged to attempt at least 16 units per semester to ensure that degree objectives can be reached within the Maximum Time-Frame. Students who attempt a lower number of units per semester should work closely with their academic adviser to ensure degree progress.

Pace of Progression is calculated by dividing the cumulative number of units the student has successfully completed by the cumulative number of units the student has attempted.

For purposes of Pace of Progression and Maximum Time-Frame, “attempted units” includes most types of course work in which you are enrolled past the course’s deadline to drop and receive a tuition refund. After this deadline, “dropped” course work is considered withdrawn units attempted for the purposes of SAP, even if the withdrawal does not result in a “W” mark on your transcript. To verify your course session’s deadline to drop for a tuition refund, please refer to the USC Schedule of Classes at classes.usc.edu.

Courses that are successfully petitioned for deletion through the Office of Academic Records and Registrar will be considered neither attempted nor completed for the purposes of Pace of Progression and Maximum Time-Frame.

Table 5

Impact of Grades on Pace of Progression and Maximum Time-Frame

| Grade Earned |

Pace of Progression |

Counted Toward Maximum Time-Frame |

| Units Completed |

Units Attempted |

| A, B, C, D (+/-) |

Yes |

Yes |

Yes |

| CR, P |

Yes |

Yes |

Yes |

| IN, IP, W, NS, MG |

No |

Yes |

Yes |

| F, IX, NP, NC, UW |

No |

Yes |

Yes |

| V |

No |

No |

No |

Table 6

Impact of Course Types on Pace of Progression and Maximum Time-Frame

| Course Type |

Pace of Progression |

Counted Toward Maximum

Time-Frame |

| Units Completed |

Units Attempted |

| Undergraduate and graduate course work (course numbers 100 and above) |

Yes |

Yes |

Yes |

| Preparatory course work (course numbers below 100) |

No |

No |

No |

| Repeated course work (previous passing grade) |

Yes |

Yes |

Yes |

| Repeated course work (previous failing grade) |

Yes |

Yes |

Yes |

| Transfer course work (pre- and post-matriculation) |

Yes |

Yes |

Yes |

| Course work dropped after Last Day to Drop and Receive a Refund, but before Last Day to Withdraw without a “W” on Transcript |

No |

Yes |

Yes |

| Course work successfully petitioned for deletion from the transcript by the Registrar |

No |

No |

No |

Maximum Time-Frame Requirement

Students must complete their degree objective within a specified amount of time. The time frame will depend on the student’s enrollment status and educational objective. Students will be eligible for the maximum attempted units or the maximum SAP semesters, whichever comes first.

Maximum Units and Semesters

Undergraduate students in single-degree, four-year programs requiring 128 units are eligible for financial aid for a maximum of 144 total attempted units or a maximum of nine SAP semesters, whichever comes first. The time frame will be increased as necessary for single-degree programs requiring more than 128 units. For example, students pursuing a five-year, single-degree program, such as the Bachelor of Architecture, will be eligible to receive financial aid for a maximum of 176 attempted units or 11 SAP semesters.

SAP Semesters

Each semester in which a student attempts 12 or more units is counted as a full (1.0) SAP semester. Each semester in which a student attempts 6 to 11 units is counted as a one-half (0.5) SAP semester. Semesters in which a student attempts fewer than 6 units are not counted as SAP semesters.

Additionally, both pre- and post-matriculation transfer units may be counted as SAP semesters. The total number of transfer units is divided by an average of 16 units per semester and rounded down to the nearest half-SAP semester.

Special Financial Aid Considerations for Students Completing Minors, Double Majors or Dual Degrees

Students pursuing minors, double majors or dual degree programs are subject to the same Maximum Time-Frame Allowance requirements as students pursuing a single major or degree. Students may appeal for allowance past the Maximum Time Frame, not to exceed 150 percent of the time frame to complete one undergraduate degree.

How and When Satisfactory Academic Progress is Monitored

The Financial Aid Office evaluates the three SAP criteria for all undergraduate financial aid applicants at the end of each enrolled semester after grades have been made official by the Office of Academic Records and Registrar.

Potential Delay of Disbursements Due to Monitoring of Satisfactory Academic Progress

Financial aid may not be disbursed to a student’s account until SAP has been evaluated. The Financial Aid Office cannot complete the SAP evaluation until prior semester grades have been officially posted by the Office of Academic Records and Registrar. An otherwise eligible student who is in a one-semester SAP Warning Period or on an SAP Contract may experience a delayed financial aid disbursement if grades are not made official before the beginning of the subsequent semester. No exceptions can be made to this process.

Notification of Satisfactory Academic Progress Status

Students who have successfully met SAP requirements will not receive an SAP notification. The Financial Aid Office will notify any student who does not meet SAP requirements via the student’s USC email address. Students who are notified that they do not meet the SAP requirements for financial aid should consult their academic advisers.

Financial Aid SAP Warning Period

Students who do not meet the GPA or Pace of Progression requirements will be placed on a one-time, one-semester financial aid SAP Warning Period. Students may continue to receive financial aid while in this one-semester Warning Period without a written appeal. Students who are in an SAP Warning Period are encouraged to seek both academic and financial aid advisement. If the minimum requirements are not met by the end of the Warning Period, the student will no longer be considered to be making SAP and will become ineligible for financial aid without an approved, written SAP Appeal. The one-semester financial aid SAP Warning is only available to students one time throughout their degree program.

Failure to Maintain Satisfactory Academic Progress

Students who fail to meet GPA or Pace of Progression standards by the end of the one-time, one-semester Warning period, or who have reached the Maximum Time Frame, will be ineligible for financial aid without an approved, written SAP Appeal. The Financial Aid Office will never increase the Maximum Time Frame past 150 percent of the published requirements for one undergraduate degree program. As soon as a student is mathematically incapable of completing a degree program within 150 percent of the published requirements, the student will be ineligible for financial aid from that point forward.

Regaining Financial Aid Eligibility

Regaining Financial Aid Eligibility with a Grade Change or Academic Improvement

Students who have lost financial aid eligibility as a result of insufficient GPA or Pace of Progression can be reinstated by a grade change or by successfully completing sufficient units or bringing up their GPA to meet the accepted standards by the end of their warning period. The student must notify the Financial Aid Office in writing once the requirements have been met.

Financial aid cannot be reinstated retroactively. If the grade change will take more than one semester to complete, it may be more expeditious to reinstate eligibility with an approved, written SAP Appeal.

Regaining Financial Aid Eligibility with an SAP Appeal for Maximum Time Frame

Students who need additional time to complete their degrees must meet with their academic adviser to complete a SAP Appeal Form. Students must also update their expected graduation date with the Degree Progress Office. The Financial Aid Office may increase the maximum time frame for students who have changed majors, are adding a minor or a major, or have experienced a one-time extenuating circumstance such as illness or injury that has since been resolved. However, the Financial Aid Office will not approve any appeal when the additional time required for completing the degree objective(s) extends beyond 150 percent of one undergraduate degree.

Regaining Financial Aid Eligibility with an SAP Appeal for GPA and/or Pace of Progression

Students who are not meeting Satisfactory Academic Progress GPA and/or Pace of Progression requirements by the end of the one-time, one-semester Warning Period may appeal to have their financial aid eligibility reinstated on a semester-by-semester basis. Students must meet with their academic adviser to complete an SAP Appeal Form. The following can be considered: extended illness; one-time extenuating circumstances that have since been resolved; and enrollment limitations due to academic advisement.

SAP Appeal Form and Letter

The student and the academic adviser must submit a Satisfactory Academic Progress Appeal form with complete supporting documentation to the Financial Aid Office. The SAP Appeal Form must contain the specific academic plan for the student that the adviser has approved. For the appeal to be approved, the academic plan must lead to graduation within 150 percent of the published time frame and unit requirements to complete one undergraduate degree program.

The student must also provide a written letter that addresses the reasons for the appeal.

Students requesting an extension past the Maximum Time Frame should address the following points in their letters of appeal:

(1) What prevented the student from completing their degree program(s) within the Maximum Time Frame?

(2) How does the student intend to ensure completion of the degree program(s) within no more than 150 percent of the published time frame to complete one undergraduate degree program?

Students appealing due to unsatisfactory GPA and/or Pace of Progress, or failing to meet the terms of an existing SAP contract, should address the following points in their letters of appeal:

(1) What caused the work at USC to fall below acceptable standards? Students should think carefully and provide a specific explanation.

(2) How have those conflicts been resolved?

(3) How will the student maintain good academic standards and progress toward the degree if the appeal is granted?

Limitations on Approvals for SAP Appeals

The Financial Aid Office will never increase the Maximum Time Frame past 150 percent of the published degree requirements for one undergraduate degree. As soon as a student is mathematically incapable of completing their degree objective(s) within 150 percent of the published requirements for one undergraduate degree, the student will be ineligible for financial aid from that point forward.

Minors, double majors and/or dual degree programs must be completed within 150 percent of the requirements to complete one undergraduate degree.

Notification of SAP Appeal Decisions

SAP Appeals will be evaluated and the Financial Aid Office will notify the student of the decision via email at the student’s USC email address.

The Financial Aid SAP Contract

Appeals for insufficient Pace of Progression and/or GPA are approved through the use of a semester-by-semester SAP Contract. Appeals for extensions to the Maximum Time Frame may also result in an SAP Contract to ensure completion within 150 percent of the time frame to complete one undergraduate degree. Students must adhere to the academic plan and terms and conditions of the SAP Contract to maintain future financial aid eligibility. The Financial Aid Office will review a student’s academic progress each semester to ensure the student has met the specific terms of the student’s contract.

The SAP Contract is a written agreement between the student, the academic adviser and the Financial Aid Office in which the student commits to following a specific academic plan that leads to graduation. Reinstated eligibility through a contract may alter the type and amount of financial aid for which a student is eligible. Terms of the SAP Contract may be stricter than the standard SAP regulations cited in this section. Acceptance of the approved SAP Contract supersedes all other SAP regulations. Any deviation by the student from the terms of the contract results in the forfeiture of future financial aid eligibility.

Submitting SAP Appeals after Failing SAP Contract

Students on SAP Contracts as a result of an approved appeal who fail to meet the terms of their accepted SAP Contracts are ineligible for future financial aid but may submit a subsequent SAP Appeal. However, these appeals are granted on an exception basis. Students will be required to document specifically the exceptional circumstances that caused them to fail their SAP Contract and how those problems have been resolved.

Financial Aid Application and SAP Appeal Deadlines

Students appealing their Satisfactory Academic Progress status must meet all financial aid application deadlines and other eligibility requirements.

Students should not submit SAP Appeals for GPA or Pace of Progression deficiencies when they are in a Financial Aid SAP Warning period. These preemptive appeals are unnecessary and will be withdrawn. Rather, students should wait until they have been notified by the Financial Aid Office that they are ineligible for financial aid due to an SAP deficiency. SAP Appeals for Maximum Time-Frame Allowance may be submitted at any time, but students should first ensure that the Degree Progress Office has updated their expected graduation term.

An SAP Appeal must be submitted before the end of the semester for which the aid is sought. Financial aid cannot be reinstated retroactively for a past semester.

Withdrawal Implications for Recipients of Financial Aid

During the Drop/Add Period

During the university’s published drop/add period, students who drop or reduce their enrollment may be eligible for a 100 percent refund of tuition for classes dropped.

Financial aid recipients must immediately notify the Financial Aid Office in writing when a drop from one or more classes during the drop/add period results in an enrollment status different from the enrollment status on which their current financial aid eligibility was based. The same applies if one or more classes are canceled.

The Financial Aid Office will review the student’s new enrollment and, if appropriate, revise the student’s eligibility based on the new enrollment status.

If a financial aid recipient drops from all classes or drops to less than half-time status during the drop/add period, all financial aid awards must be returned to their respective programs. Students who drop from all classes or drop to less than half-time status during the drop/add period are considered never to have established eligibility for financial aid. If the student was given financial aid funds for other expenses, the student will be expected to return those funds to the university.

After the Drop/Add Period

Students who are recipients of Title IV federal student aid are also covered by federal Return of Title IV Funds (R2T4) regulations. Title IV federal student aid is awarded to a student under the assumption that the student will attend for the entire period for which the assistance is provided and thereby “earn” the award. When a student ceases academic attendance prior to the end of that period, the student may no longer be eligible for the full amount of federal funds that the student was originally scheduled to receive.

If a Title IV recipient withdraws from all classes on or before the session is 60 percent complete, based on their last date of attendance, federal policy requires that any “unearned” Title IV federal student aid be returned to the U.S. Treasury, even if the student is not entitled to a refund of tuition.

A student is required to immediately notify the Registrar when the student stops attending classes. If the student fails to notify the Registrar’s Office, it is possible that the 50 percent point in the term will be used to determine the student’s last date of attendance, in accordance with federal regulations. If a student withdraws from all classes*, the Financial Aid Office will determine if that student’s period of attendance resulted in the earning of all federal student aid awarded for that term. If it is determined that not all the scheduled federal aid has in fact been earned, then the Financial Aid Office will calculate the amount to be returned to the federal student aid programs. The Financial Aid Office will bill the student via the student’s university account for the amount to be returned. It is the student’s responsibility to contact the Cashier’s Office to settle the bill.

*Note to students in modular programs: In a modular program, one or more of the student’s enrolled courses do not span the length of the entire semester. Students in modular courses who withdraw from one or more courses but are still registered for future courses within the term will be required to confirm their future enrollment plans. For students who fail to confirm or fail to re-enroll, the Financial Aid Office will determine whether you have completed module(s) that contain 49 percent or more of the number of days in the payment period. If you have completed 49 percent or more, you are not considered to have withdrawn for R2T4 purposes. If you have completed less than 49 percent, the Financial Aid Office will calculate the portion of your financial aid that has been earned based on your latest date of attendance. Refunds to the U.S. Treasury may be required.

Additional Responsibilities of Students Who Withdraw

Any time a student withdraws from one or more courses, the student should consider the potential effect on their Satisfactory Academic Progress (SAP) status. See here for more information about SAP requirements.

Whenever a student’s enrollment drops to less than half time or the student withdraws completely, or if a student takes a leave of absence, they must notify the lender, holder or servicer of any loans. Student borrowers of federal or university loans must also satisfy exit loan counseling requirements at iGrad.

It is also the student’s responsibility upon withdrawal from all classes to notify the Student Financial Services Office, the Housing Services Office, the Transportation Services Office and/or the USCard Office, if the student has charges from these offices on their student account. Students who have withdrawn from studies may be entitled to a prorated cancellation of charges from these offices.

Leave of Absence

Financial aid recipients considering a leave of absence should be aware of the financial aid implications. Although obtaining an approved leave of absence from their programs does allow students to re-enroll in the university without formal re-admission, it does not allow them to avoid Return to Title IV calculations or defer their loan repayment. The university reports student enrollment to the National Student Clearinghouse throughout the academic year. Lenders and federal loan service agencies subsequently query this database to determine if a student has maintained continuous half-time or greater enrollment.

Student Loan Repayment

If students are on a leave of absence from the university, their lender or federal loan service agency will move their loan from an “in-school” status to a grace or repayment status as required. While on a leave of absence, students may be able to postpone repayment by obtaining a deferment or forbearance from their loan servicer(s) as a result of unemployment or economic hardship. Students should contact their loan servicer(s) for more information about loan repayment. Students may review their federal loan history and determine their loan service agencies by visiting the Federal Student Aid website at studentaid.gov. Once they re-enroll on a half-time or greater basis, they may be able to request deferment for “in-school” status.

Tuition Refund Insurance Plan

To complement its own refund policy, the university makes available to students Tuition Refund Insurance, an insurance policy designed to protect the investment students and their families make in education. The Financial Aid Office strongly encourages all financial aid recipients to take advantage of this plan. If a student formally withdraws from all classes after the end of the drop/add period and they are covered by Tuition Refund Insurance, the student may receive:

- A credit to the student account equal to 85 percent of charges for tuition and mandatory fees, if the withdrawal is the result of a documented injury, sickness, or psychological or emotional condition (as defined in the DSM-IV manual).

The Tuition Refund Insurance credit will be applied first to any outstanding charges on the student’s university account, including any charges resulting from the return of Title IV federal student aid. Recipients of university and/or federal financial aid will then receive a cash refund equal to the amount of cash payments made towards tuition and fees plus any loan payments still on the account (after all returns of Title IV aid have been made in accordance with federal policies, if applicable). The remainder of the insurance credit will be used to repay university financial aid grant or scholarship programs.

Brochures about Tuition Refund Insurance requirements and claim forms are available in the Cashier’s Office and the Registrar’s Office. All questions about the insurance plan should be directed to these offices.

Notes on Federal Policy

Title IV Federal Student Aid

Students are considered recipients of Title IV federal student aid if they have received funds from one or more of the following programs to meet educational expenses for the semester in question: Federal Pell Grants, Federal Supplemental Educational Opportunity Grants (FSEOG), Direct Loans (Subsidized or Unsubsidized), or Direct Graduate or Parent PLUS Loans.

FAFSA and Verification

The Department of Education’s deadline for receipt of a 2023-24 FAFSA is June 30, 2023. To receive financial aid funds, a complete, valid FAFSA must be received at USC by the last day of the student’s 2023-24 enrollment.

Financial aid applicants selected for verification are required to submit documentation before any financial aid funds will be awarded or disbursed. The deadline to submit verification documentation is 120 days after the student’s last date of enrollment for 2023-24, or September 10, 2024, whichever is earlier. USC will continue to accept verification documentation until this date.

Applicants are notified of any changes to their financial aid eligibility on their Financial Aid Summary and Tasks (FAST) page. The FAST page also indicates any outstanding documentation or tasks that need to be completed for aid to be processed or disbursed.

Period of Enrollment

At USC, the periods of enrollment are generally measured using the session(s) in which the student enrolled on a semester basis, starting on the first day of classes and ending on the final day of examinations for a given term. For purposes of Title IV federal student aid, any scheduled break of five or more days will not be included in the measurement of the enrollment period. For programs offered in modules (sessions that do not span the entire length of the semester), breaks of more than five days between modules will not be included in the measurement of the enrollment period.

Measurement of Earned Title IV Federal Student Aid

When a student withdraws from all classes or withdraws from one or more classes while attending a modular program, the Financial Aid Office will calculate the percentage of earned Title IV federal student aid using the date of withdrawal. The earnings calculation is based on the number of days of enrollment, up to and including the day of withdrawal, divided by the total number of days in the enrollment period. In most cases, when a total withdrawal is determined to occur on or before the 60 percent point in a semester, some federal aid will need to be returned.

Return of Title IV Federal Student Aid

To satisfy federal regulation, returns to Title IV financial aid programs must be made in the following order:

- Direct Unsubsidized Loans

- Direct Subsidized Loans

- Direct PLUS Loans

- Federal Pell Grants

- Federal Supplemental Educational Opportunity Grants (SEOG)

- Other Title IV federal programs

Financial Aid Policy Regarding Falsification of Financial Aid Information

The types of information covered by this policy include all documents and information submitted to apply for and/or receive need-based financial aid, scholarships and private financing funds. These documents and information include, but are not limited to, the following:

- Free Application for Federal Student Aid (FAFSA)

- Student Aid Report (SAR)

- CSS Financial Aid/Profile Application and CSS Noncustodial Parent Profile Application

- Financial Aid Supplement

- Student and parent federal income tax forms and other income documentation

- Documentation of U.S. citizenship or eligible non-citizen status

- Documentation of housing/living arrangements

- Academic documents relating to high school diploma or college course work

- Loan applications, promissory notes and related documentation

- Specific program applications

- Federal Work-Study time sheets

- Any university financial aid forms and related documentation

- Any written, electronic or verbal statements sent to or made to a university employee regarding the student’s financial aid application or other financially related documents

The integrity of the documents and the honesty of the information presented through them are critical to the financial aid process. Students should be aware that they will be held responsible for the integrity of any financial aid information submitted either by them or on their behalf.

If the university determines that a student or parent has provided falsified information, or has submitted forged documents or signatures, the following steps may be taken without prior notification to the student or parent:

- An incident report will be filed with the Office of Community Expectations following procedures outlined in the student handbook. Pending resolution of the report, the Financial Aid Office may restrict the distribution of any further aid to the accused student.

- If the Financial Aid Office or the student conduct review process finds that a violation has occurred, the consequences may include, but are not limited to, the following:

- The student will be required to make full restitution of any and all federal, state, private and/or university scholarship, grant, loan or work funds to which they were not entitled.

- Until full restitution is made, all federal, state and university funds will be withheld from the student, including all funds disbursed in past or in current terms.

- No arrangements will be made with the Cashier’s Office or Collections Office on the student’s behalf to settle their account. The student will be responsible for all charges incurred on the student’s account because of the loss of federal, state or institutional financial aid funds.

- If the student is determined to be ineligible for financial aid because of a basic eligibility criterion, no further federal, state or university funds will be provided to the student in any future terms of enrollment at the university.

- The student may be ineligible for future participation in some or all financial aid programs for a minimum of one year or longer. In some cases, the student will not be eligible to receive funds from that program in any future terms of enrollment at the university.

- The student will not receive funds to replace those lost because they are considered ineligible due to dishonesty.

- In addition to any consequences directly related to the student’s financial aid, the student may be referred to the Office of Community Expectations for disciplinary action.

- As required by federal and state law, the USC Financial Aid Office will report any infraction to the appropriate office or agency. These include, but are not limited to, the U.S. Department of Education Office of the Inspector General, state agencies or other entities that may take whatever action is required by federal and state law. In this report, the Financial Aid Office will describe in detail the incident, the response from the Financial Aid Office and any additional actions taken by or pending with the university.

|

You must be logged in to post a comment.