USC Catalogue 2015-2016 [ARCHIVED CATALOGUE]

USC Leventhal School of Accounting

|

|

Return to: USC Marshall School of Business

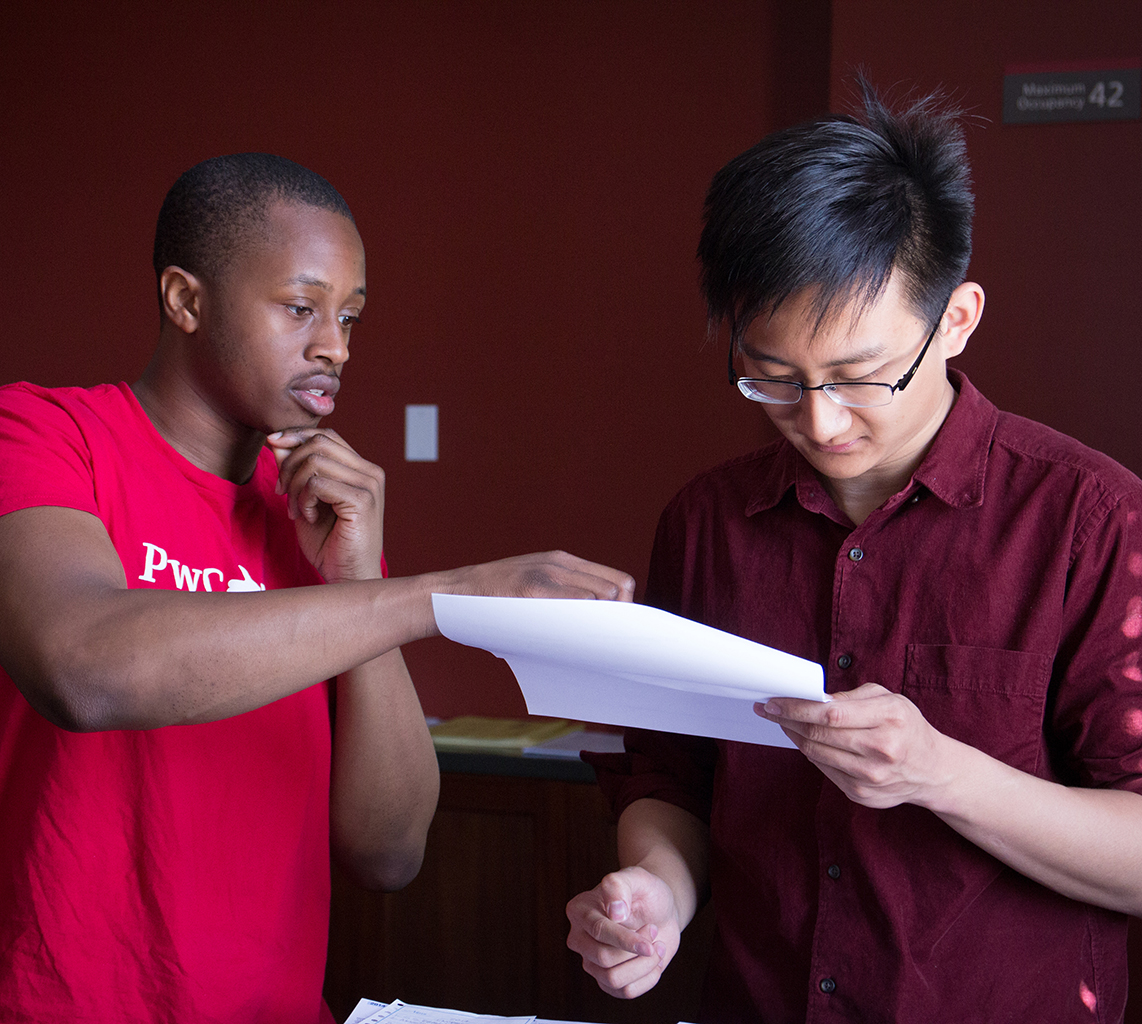

USC Leventhal School of Accounting students Oluwambe Ekundayo and Linwei Li prepare tax returns for the local community and students as part of VITA’s (Volunteer Income Tax Association) annual free program. As part of the Marshall School of Business, Leventhal enables students to combine real-world skills with technical proficiency.

Photo by Joseph Chen.

The USC Leventhal School of Accounting is dedicated to maintaining a leadership position in accounting education and research. We are committed to educational programs that seek to establish in each graduate the potential for career development into the highest executive levels of public accounting, controllership, financial management and management of accounting information systems. The accounting curriculum explores not only the state of the art but also seeks to explore the accounting discipline’s future structures and directions. Relevant concepts and techniques from other academic disciplines are drawn upon and integrated into all accounting programs.

Accounting education has been an integral part of USC since 1920, when the Department of Accounting offered a Bachelor of Science degree in business administration with an emphasis in accounting. The Leventhal School of Accounting was established in 1979 in recognition of the growing importance of accounting to our economy and broader society. It continues to rank as one of the premier AACSB-accredited accounting programs in the nation.

Currently the Leventhal School of Accounting undergraduate program offers a Bachelor of Science accounting degree. Honors students may be eligible for early admission to the graduate program, an efficient way to complete both undergraduate and graduate degrees. An accounting minor is also offered to students outside the USC Marshall School of Business. Graduate programs include a full-time Master of Accounting or Master of Business Taxation; a Master of Business Taxation for working professionals; and a Juris Doctor/Master of Business Taxation in conjunction with the USC Gould School of Law. A PhD degree with an accounting major is offered through the doctoral program in the Marshall School of Business.

USC Leventhal School of Accounting

Accounting 101

(213) 740-4838

FAX: (213) 747-2815

Email (graduate students): MAcc.MBT@marshall.usc.edu; (undergraduate students) lsoa_undergrad@marshall.usc.edu

marshall.usc.edu/lsoa

Administration

William W. Holder, DBA, CPA, Dean, Alan Casden Dean’s Chair at the Leventhal School of Accounting

Mark L. DeFond, PhD, CPA, Associate Dean, Faculty Affairs

Shirley Maxey, BA*, Associate Dean, Master’s Programs

Mildred G. Penner, MA, Assistant Dean, Undergraduate Program

Faculty

George Bozanic and Holman G. Hurt Chair in Sports and Entertainment Business: S. Mark Young, PhD*

Deloitte & Touche LLP Chair in Accountancy: Kenneth A. Merchant, PhD, CPA

A.N. Mosich Chair in Accounting: Mark L. DeFond, PhD, CPA*

Accounting Circle Professor of Accounting: Randolph P. Beatty, PhD, CPA

KPMG Foundation Professor of Accounting: K.R. Subramanyam, PhD

Ernst & Young Professor of Accounting: Sarah E. Bonner, PhD, CPA*

Arthur Andersen & Co. Alumni Associate Professor of Accounting: Mark Soliman, PhD*

Accounting Associates Professor of Accounting: Clive Lennox, PhD

Professors: Randolph P. Beatty, PhD, CPA; Sarah E. Bonner, PhD, CPA*; Mark L. DeFond, PhD, CPA*; William W. Holder, DBA, CPA; Clive Lennox, PhD; Thomas W. Lin, PhD, CMA; Kenneth A. Merchant, PhD, CPA; Daniel E. O’Leary, PhD, CPA, CMA, CISA; K.R. Subramanyam, PhD; Charles W. Swenson, PhD*, CPA; S. Mark Young, PhD*

Associate Professors: John J. Barcal, JD, CPA*; Shane M. Heitzman, PhD; Mark Soliman, PhD, CPA; Shiing-Wu Wang, PhD*; Regina Wittenberg-Moerman, PhD

Assistant Professors: Eric Allen, PhD, CPA; Elizabeth Chuk, PhD; David Erkens, PhD; Maria Loumioti, PhD; Maria Ogneva, PhD; Julie Suh, PhD; David Tsui, PhD; Marshall Vance, PhD

Professors of Clinical Accounting: Ruben A. Davila, JD, MBA, CPA; Chrislynn Freed, MBA, CPA*; Merle Hopkins, PhD*; Cecil W. Jackson, PhD, CPA; Joseph L. Keller, MS, CPA; Rose M. Layton, MAcc, CPA*; Shirley Maxey, BA*; Patricia Mills, JD, LLM; Leslie R. Porter, PhD*; Kendall Simmonds, MBA, CPA*

Associate Professor of Clinical Accounting: Robert Kiddoo, MBA, CPA

Assistant Professors of Clinical Accounting: Smrity Randhawa, PhD; Lori Smith, BS, CPA; Zivia Sweeney, MBA, CPA*

Professor of the Practice of Accounting: Thomas P. Ryan, MBA

Emeritus Professors: Jerry L. Arnold, PhD, CPA; E. John Larsen, DBA, CPA; Theodore J. Mock, PhD; ZoeVonna Palmrose, PhD

*Recipient of university-wide or school teaching award.

Degree Programs

Undergraduate Degree

Bachelor of Science, Accounting

The USC Leventhal School of Accounting offers the Bachelor of Science, Accounting (BS) degree designed to provide students with a broad foundation in accounting and business to prepare them for entry into the professional program leading to a Master of Accounting or Master of Business Taxation degree. The undergraduate curriculum also provides the background necessary for direct entry into the accounting profession.

Graduate Degrees

Master of Accounting

The Master of Accounting (MAcc) program provides an integrated curriculum designed to prepare graduates for careers in professional accounting, public accounting, industry and government. Students have the opportunity to study accounting in greater depth and in more areas of specialization than in undergraduate accounting programs or MBA programs with concentrations in accounting. Students have flexibility in elective choices to reflect their career goals.

Admission does not require an accounting or business undergraduate degree, nor is work experience a requirement. For students with an undergraduate degree in accounting, the program requires 30 units for completion; for students without the prerequisite accounting course work, the program requires 45–48 units. The variation in units depends on the student’s educational background and completed course work. This degree is designed to be completed by full-time students.

Master of Business Taxation

The Master of Business Taxation (MBT) degree is offered to both full-time and part-time students. This specialized program in taxation requires 30 units for students with the required accounting education. For students without the prerequisite accounting knowledge, the program requires 45-48 units. The program is designed for accountants, attorneys and business professionals who wish to learn or improve skills and knowledge through participation in advanced tax study. Students have flexibility in elective choices to reflect their career focus and goals. The part-time program is referred to as the MBT for Working Professionals (MBTWP).

Juris Doctor/Master of Business Taxation

The USC Gould School of Law and the Leventhal School of Accounting offer this dual degree program. Admission to the JD program offered by the Law School is required before applying to the MBT program offered by the Leventhal School of Accounting.

Master of Business Administration

The Master of Business Administration (MBA) is offered by the Marshall School of Business and is also serviced by the Leventhal School of Accounting. For additional information, consult the USC Marshall School of Business section in this catalogue.

Doctor of Philosophy

The Marshall School of Business offers the Doctor of Philosophy (PhD) degree in conjunction with the Graduate School. A student electing to major in accounting may design a research program that emphasizes auditing, financial accounting, information systems, management accounting or taxation. More information on the doctoral program is available in the USC Marshall School of Business section of this catalogue, or contact the doctoral office at (213) 740-0674 or the director of doctoral studies in accounting at (213) 740-4838.

Graduate Degrees

The USC Leventhal School of Accounting offers two graduate degrees: the Master of Accounting (MAcc) and the Master of Business Taxation (MBT). The MAcc program provides an integrated curriculum designed to prepare graduates for careers in professional accounting, public accounting, industry and government. Students have the opportunity to study accounting in greater depth and in more areas of specialization than in undergraduate accounting programs or MBA programs with concentrations in accounting. The MBT program provides in-depth specialization in taxation to prepare the student for a successful career as a tax professional whether in public accounting, industry, government, the investment arena, or entrepreneurship.

The Leventhal School of Accounting also offers the dual Juris Doctor/Master of Business Taxation (JD/MBT) degree program in conjunction with the USC Gould School of Law. The combination of broad legal education with detailed tax specialization prepares graduates for fast-track careers in law and tax practices.

The Marshall School of Business offers the Doctor of Philosophy (PhD) degree in conjunction with the Graduate School. A student electing to major in accounting may design a research program that emphasizes auditing, financial accounting, information systems, management accounting or taxation. For more information on the doctoral program, see the Marshall School of Business section of this catalogue, or contact the doctoral office at (213) 740-0670 or the director of doctoral studies in accounting at (213) 740-5025.

Admission to Master’s Programs

The Leventhal School of Accounting seeks individuals who have the potential for outstanding achievement in accounting or taxation. The Admissions Committee uses the holistic review model. Candidates are reviewed on the merits of their application and the merits of the applicant pool for the year in which they seek admission.

Applicants to the full-time programs are not required to have previous work experience. Applicants to the parttime MBT program (MBTWP) are required to have a minimum of one year full-time professional experience related to taxation after receiving an undergraduate degree.

Application to the Programs

An admission decision requires the following: (1) a completed USC Leventhal School of Accounting online graduate application (available at www.marshall.usc.edu/admissions/applyonline); (2) a non-refundable application fee; (3) one official transcript from the registrar of each college or university attended (undergraduate and/or postgraduate); (4) two letters of recommendation; (5) a professional resume; (6) an official Graduate Management Admission Test (GMAT) score report or, for JD/MBT applicants or attorneys, an official Law School Admission Test (LSAT) score report; and (7) an essay. Finalist must also complete an interview.

Applicants for the JD/MBT dual degree program should apply to the Leventhal School of Accounting for admission to the MBT program in the second semester of their first year in the USC Gould School of Law. In addition, current Law School transcripts and a “letter in good standing” from the registrar of the Law School must be submitted as part of the application. The same Leventhal School of Accounting admission criteria apply to the MBT portion of the JD/MBT program.

International Students

In addition to the application requirements noted above, all international students must submit TOEFL or IELTS scores. A letter of financial support is also required.

MAcc/MBT for Current USC Students

The Leventhal School of Accounting offers the opportunity to earn both a bachelor’s degree and a master’s degree in five years or less. This simplified, early admission process is for current USC students who have demonstrated exceptional academic success in undergraduate studies and who have completed a minimum of 70 units of course work. Strong SAT scores may be substituted for GMAT scores for continuing USC students only.

Please see a Leventhal School of Accounting academic adviser for further information and to develop a course plan proposal.

Application Deadlines

Full-time MAcc and MBT – Applicants are urged to file a completed application as early as possible. For applications to the full-time programs that begin in summer or fall, the online application system is generally open from early October through March 31. International students must apply no later than January 10. Applicants asking for scholarship consideration should apply by mid-January to increase the likelihood of funds being available. Application decisions will be made on a rolling admission basis until the programs are filled. Applications that arrive after the regular deadline will be considered on a space-available basis.

Part-Time MBT for Working Professionals – Students may begin in the MBT.WP program in the fall or summer semester. The application deadline for summer applicants is March 31; for fall applicants, June 30. Applications that arrive after the regular deadline will be considered on a space-available basis.

Residence Requirements

Subject to approval of the Leventhal School of Accounting, the maximum number of transfer credits that may be applied toward the master’s degree is three units. To be applied to the degree, transfer work must have been completed within five years of admission to the master’s program. Graduate transfer credit will not be granted for course work taken elsewhere after a student has been admitted and enrolled at USC. Credit will only be allowed for courses (1) from an AACSB-accredited graduate school, (2) of a quality of at least 3.0 on a 4.0 grading scale, (3) constituting a fair and reasonable equivalent to current USC course work at the graduate level, and (4) fitting into the logical program for the degree. Transfer course work is applied as credit (CR) toward the degree and is not included in the calculation of a minimum grade point average for graduation.

Waivers

With the written approval of the Leventhal School of Accounting, waiver of required courses may be granted to students based upon prior academic work. All waived courses must be replaced with approved electives. Students should carefully read their program evaluation form to know what electives must be taken if they are granted subject waivers.

ProgramsBachelor’s DegreeMinorMaster’s DegreeDual DegreeCoursesAccounting

Major Restrictions

Enrollment in most 500-level business courses by non-business graduate students requires special permission. For information about the registration application process for non-business students, visit the Schedule of Classes.

|

You must be logged in to post a comment.